Executive Summary

A 12-year-old life insurance policy designed for tax-free growth and legacy transfer had gone dormant. High internal costs, expensive riders, and a lack of active management left it stagnating with declining cash value. Our firm performed a complete structural audit, eliminated unnecessary riders, shifted allocations into institutional-grade options, and repositioned the policy for long-term efficiency.

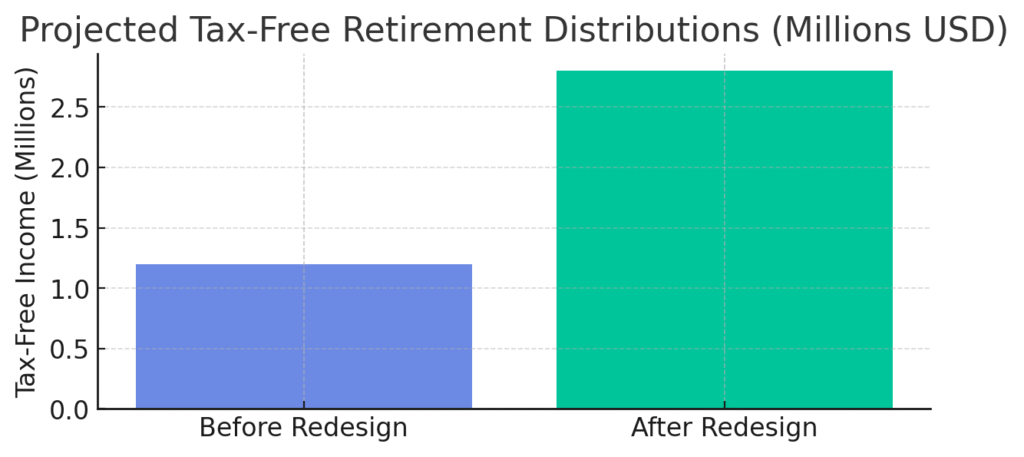

The result was transformative: the same policy—without new premiums—was redesigned to generate $2.8 million in projected tax-free retirement income while maintaining a strong death benefit for heirs. This “Legacy Rescue” illustrates how technical precision and proactive legal structuring can revive underperforming assets into powerful wealth-transfer tools.

When a long-standing client approached us with a twelve-year-old life insurance policy, it quickly became clear that time had dulled what was once a strong financial instrument. The policy had been designed in the early 2010s as a cornerstone of a legacy and tax-free growth strategy. Over a decade later, however, it had become stagnant, inefficient, and confusing to manage. Our review found that expensive riders, poor allocation choices, and a lack of proactive oversight had eroded both growth potential and clarity of purpose.

The client had been paying premiums faithfully, yet their cash value was actually declining. The annual statements were difficult to interpret, the projections unclear, and the intended balance between protection and growth had been lost. Like many legacy policies, the structure had simply been left on autopilot, assuming that “set and forget” would be sufficient. Unfortunately, in an evolving market with changing carrier products and new institutional allocation options, inaction proved costly.

Diagnosing the Problem

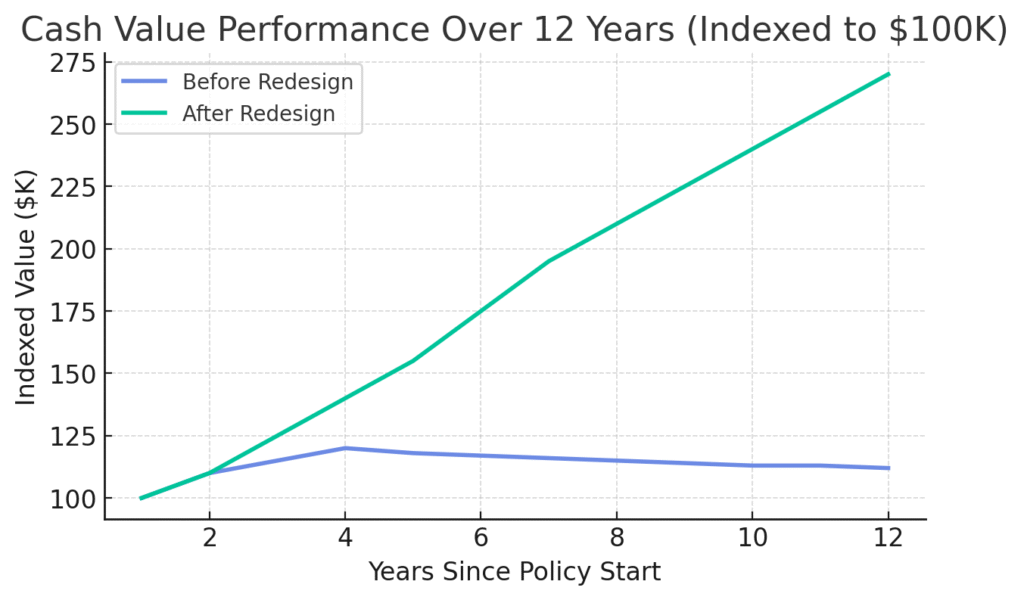

The chart below captures that story. The blue line shows how the cash value had flattened and then begun to decline after year five, while the green line represents the redesigned version that regains momentum and compounds upward.

The data tell a simple truth: even the most conservative plan requires periodic engineering. Without review, inefficiency becomes inevitable.

The Redesign

Our objective was not to replace the policy, but to rescue and repurpose it. We began by stripping away outdated riders, lowering the internal cost of insurance, and repositioning the cash value into institutional allocation options with stronger long-term growth potential. Importantly, no new premiums were required—the transformation relied entirely on intelligent restructuring of existing assets.

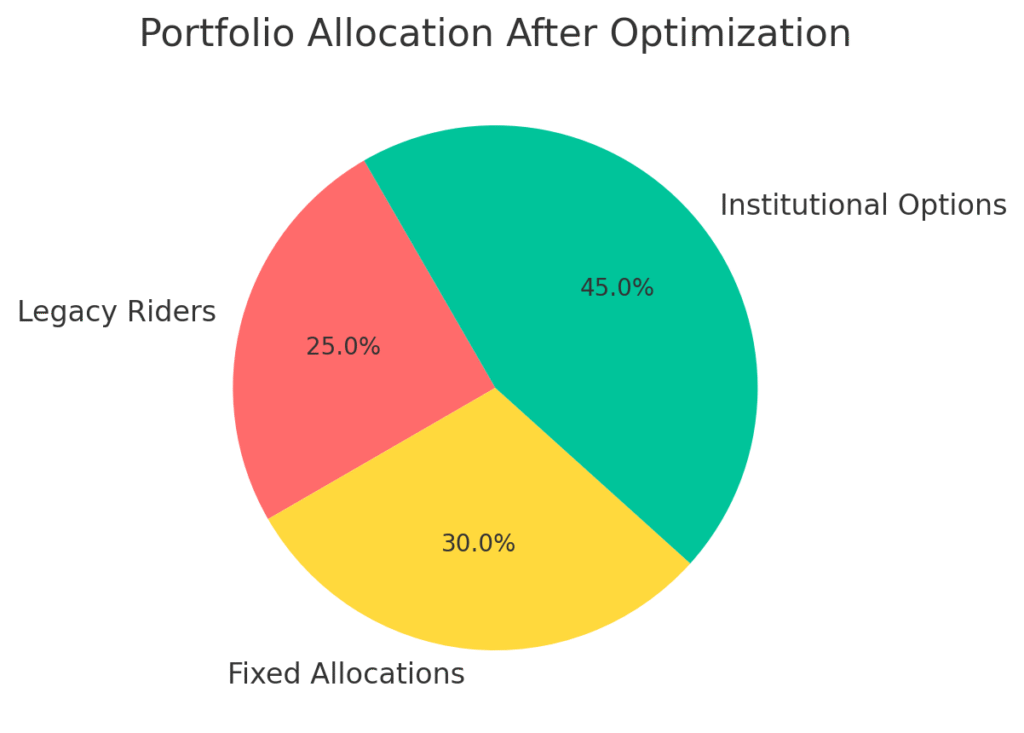

To illustrate, the following pie chart shows the new portfolio allocation after optimization. Legacy riders that once consumed twenty-five percent of value were eliminated, fixed allocations were trimmed, and institutional strategies now make up nearly half the structure.

Beyond allocation, we re-sequenced the crediting methodology to align with current market participation caps and applied a disciplined policy-loan strategy that could later provide tax-free income. Every modification was stress-tested against IRS § 7702 and MEC guidelines to ensure full compliance and longevity.

The Results