Executive Summary

Transforming Standard Solutions into Exceptional Outcomes

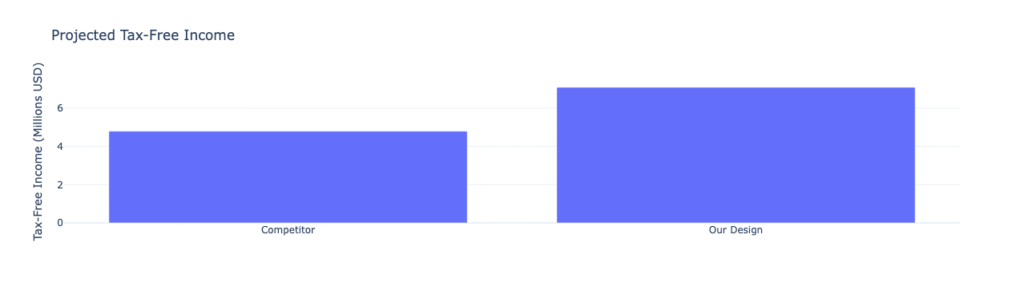

Through a meticulous redesign, we restructured the allocation, reduced internal costs, and sequenced contributions within IRS compliance frameworks. The result was striking: the very same $250,000 annual contribution now projected $7.1 million—an improvement of $2.3 million, or nearly 50% more tax-free income, achieved without adding any risk or leverage.

The Challenge of “Standard” Designs

The competitor’s illustration relied on off-the-shelf policy structures. These designs tend to load higher internal costs into the early years and fail to fully optimize the balance between base coverage and riders. The outcome is lower net cash value accumulation and diminished long-term income potential. In short, the client was paying for inefficiencies baked into a one-size-fits-all template.

Executive Summary

Transforming Standard Solutions into Exceptional Outcomes

Through a meticulous redesign, we restructured the allocation, reduced internal costs, and sequenced contributions within IRS compliance frameworks. The result was striking: the very same $250,000 annual contribution now projected $7.1 million—an improvement of $2.3 million, or nearly 50% more tax-free income, achieved without adding any risk or leverage.

The Challenge of “Standard” Designs

The competitor’s illustration relied on off-the-shelf policy structures. These designs tend to load higher internal costs into the early years and fail to fully optimize the balance between base coverage and riders. The outcome is lower net cash value accumulation and diminished long-term income potential. In short, the client was paying for inefficiencies baked into a one-size-fits-all template.

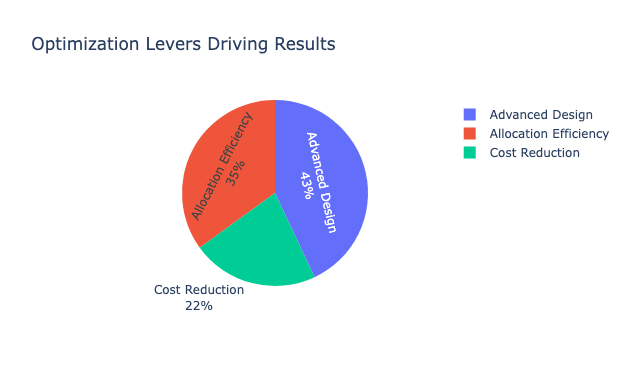

The Redesign: Engineering Without Extra Risk

Our approach focused on structure, not speculation. By reallocating premium between base policy and riders, reducing internal costs, and designing a more efficient funding sequence, we amplified the long-term compounding power of the contributions. Importantly, the design adhered strictly to IRC §7702 compliance tests and avoided Modified Endowment Contract (MEC) pitfalls by phasing premium contributions with precision.

Instead of chasing higher returns, we created a legal and structural framework that preserved safety while unlocking significantly higher tax-free loan capacity.

Side-by-Side Results

The difference between the two strategies is easy to visualize. The competitor’s design projected $4.8 million in available tax-free income. Our optimized structure raised that figure to $7.1 million, an uplift of $2.3 million achieved solely by lowering drag and improving allocation.

Compliance as the Backbone

The durability of this outcome rests on compliance. We ran the design against the §7702 CVAT and GPT tests, structured ownership to avoid Goodman Triangle issues, and coordinated with trust planning to ensure proceeds could flow efficiently through an ILIT or dynasty trust. Loan mechanics were specifically modeled using participating loans so that the policy’s cash value continued compounding even as income was distributed.

This compliance-first orientation ensures the strategy is not only powerful but legally and structurally sound.

What This Means for Sophisticated Families

For high-net-worth individuals and families, the lesson is clear. Structure outperforms speculation. By focusing on the legal and financial engineering of the policy, we increased projected tax-free income by nearly 50% without exposing the client to more risk. The additional $2.3 million is the hidden value that standard illustrations leave on the table.

This design also offered liquidity through policy loans, reducing reliance on the sale of operating businesses or illiquid assets in retirement. And with trust ownership and carefully aligned beneficiaries, the plan advanced the family’s multigenerational estate planning goals.